Mortgage calculator how much can i borrow based on salary

Borrowing power calculator - How much can I borrow. How much house can I afford.

Good Calculators Online Calculators Tax Finance Hr Mathematics Engineering Online Calculator Mathematics Math Resources

The comparison tables below display some of the variable rate home loan products on Canstars database with links to lenders websites for borrowers in NSW making principal and interest repayments on a.

. A mortgage usually includes the following key components. Compare a no-cost vs. These are terms that lenders use to describe how much you might be able to borrow based on your financial situation.

When it comes to calculating affordability your income debts and down payment are primary factors. When it comes to home loans things that affect your borrowing power include how much you earn current debt repayments like your credit card limits or personal loans number of dependants how much youve saved as a deposit and whether you have a. By default this calculator uses a 28 front-end ratio housing expenses versus income a 36 back-end ratio monthly housing plus debt payments versus income though these are variables in the calculator which you can adjust to suit your needs the limits set by your lender.

2836 are historical mortgage industry standers which are. You can use the above calculator to estimate how much you can borrow based on your salary. What are the tax savings generated.

For the two interest rates used in flexible rate mortgage the HIBOR-based mortgage plan H. You can also input your spouses income if you intend to obtain a joint application for the mortgage. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance.

This mortgage calculator will show how much you can afford. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. Using a percentage of your income can help determine how much house you can afford.

Lets presume you and your spouse have a combined total annual salary of 102200. To calculate u2018how much house can I affordu2019 a good rule of thumb is using the 2836 rule which states that you shouldnu2019t spend more than 28 of your gross monthly income on. Payoff Early Mortgage Calculator - If you want to pay off your mortgage earlier and save on interest payments learn how much you can save with the early payoff mortgage calculator.

You pay the principal with interest back to the lender over time through mortgage payments--. Mortgage principal is the amount of money you borrow from a lender. The maximum loan amount one can borrow normally correlates with.

Loan amountthe amount borrowed from a lender or bank. If a mortgage is for 250000 then the mortgage principal is 250000. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts.

These are also the basic components of a mortgage calculator. Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments Bankrate. This can be used in conjunction with our loan repayment calculator to help you to work out your repayments based on the amount you wish to borrow.

While your personal savings goals or spending habits can impact your. If you need a mortgage to finance the purchase and repair of a home you can take advantage of the FHA 203k rehab mortgage insurance. Mortgage rates valid as of 12 Sep 2022 0248 pm.

Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year. Should I refinance my mortgage. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher.

You can use filter options at the top of the page to specify how much youd like to borrow and the loan tenor. The calculator will then provide you with a list of housing loan products with varying interest rates. But if you know the starting salary of your future post-graduate position that can help you determine what you can afford when the time comes to repay.

ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for. So study your options carefully. The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt.

How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment. 15-Year Vs 30-Year Mortgage Calculator. How much can I borrow.

In a mortgage this amounts to the purchase price minus any down payment. Should I rent or buy a home. You can pay off your mortgage earlier by increasing the monthly payment or seeing the monthly mortgage payment when a borrower has a plan to pay off a mortgage.

15 20 30 year Should I pay discount points for a lower interest rate. For example the 2836 rule may help you decide how much to spend on a home. Compare home loans on Canstars database.

Our VA loan affordability calculator gives you an estimate of how much you could afford using a VA home loan based on your financial situation. Our calculator uses information from you about your income monthly expenses and loan term to calculate an. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan.

To secure this loan the repair or renovation cost must be at least 5000 including complete reconstruction and structural alterations. Factors that impact affordability. This calculator estimates your borrowing power based on your income financial commitments and loan details entered.

How much home can I afford. Comparing mortgage terms ie. Lenders may loan up to 5 times the borrowers annual salary.

Should I convert to a bi-weekly payment schedule.

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Explained Why One Should Get Instant Loans In India Instant Loans Instant Loans Online Instant Money

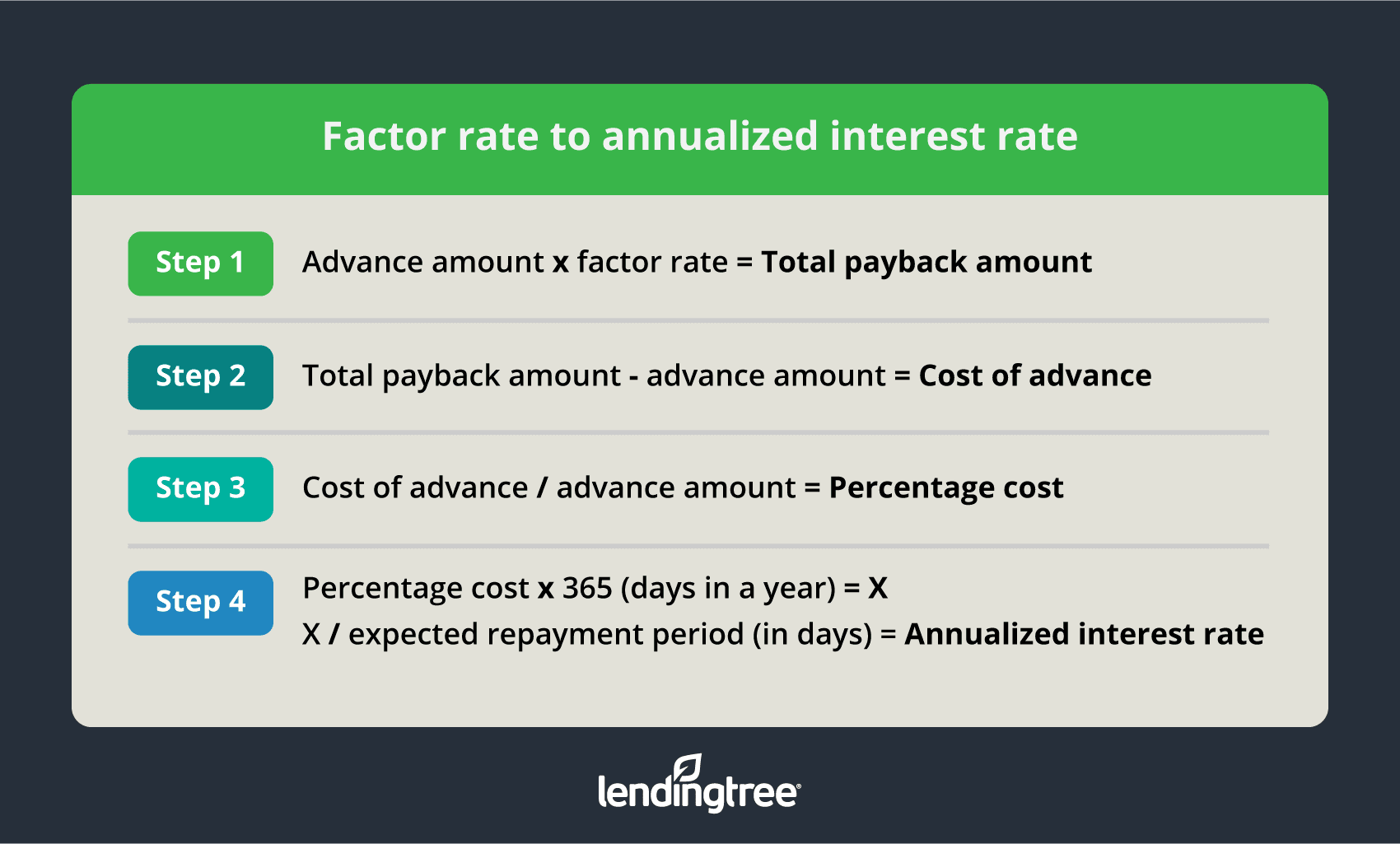

What Is A Factor Rate And How Do You Calculate It

How Much Can I Afford To Borrow Usaa

![]()

7 Top Student Loan Calculators That Do Money Saving Math For You Student Loan Hero

Mortgage Calculator Money

A Home Of Your Own Living Room Theaters Home Buying Living Room Bench

Top 5 Reasons People Take Out Personal Loans Personal Loans Unsecured Loans Person

Interest Only Mortgage Qualification Calculator Freeandclear

Free Marketing Ideas For Mortgage Loan Officers Mortgage Loans Mortgage Marketing

How Much House Can I Afford Calculator Money

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How To Calculate Salary Increase Percentage In Excel Free Template Salary Increase Salary Salary Calculator

Home Affordability Calculator Credit Karma

How Much Can I Borrow Calculator Mortgage Calculators

Retirement Savings Spreadsheet Spreadsheet Savings Calculator Saving For Retirement